Dear Studio Fam,

It was not that long ago that the airwaves were filled with celebrities hawking all manner of cryptocurrency but this week we bring news of one particular mega celebrity who surprisingly did more diligence on FTX than some of the most prestigious VCs. You'll also find a new shopping experience from a major credit startup, the latest installment of Elon Musk's complicated relationship with government regulators, and a brief on the state of antitrust regulation of big tech mergers.

Taylor Swift Actually Did Diligence On FTX, Elon “Not Surprised”

Taylor Swift has avoided a potential lawsuit from FTX, a cryptocurrency exchange, by asking a simple question. FTX had hoped to add Taylor Swift to its cadre of mega celebrity endorsers like Larry David and Tom Brady, but she declined after negotiations broke down over a simple question: Are NFTs unregulated securities?

It’s a perfectly valid question in the face of increasing regulatory crackdown on the crypto industry and FTX obviously did not have a satisfactory response. The communications came to light as part of the discovery process of a $5 billion lawsuit against celebrities who took massive payments to promote exchanges like FTX and NFTs like Bored Apes.

Elon Musk, who has previously endorsed Bitcoin and Dogecoin but derided centralized exchanges, tweeted that he was not surprised by Swift’s scrutiny because her father is a respected investment banker.

Klarna Debuts AI Powered Shopping Feed

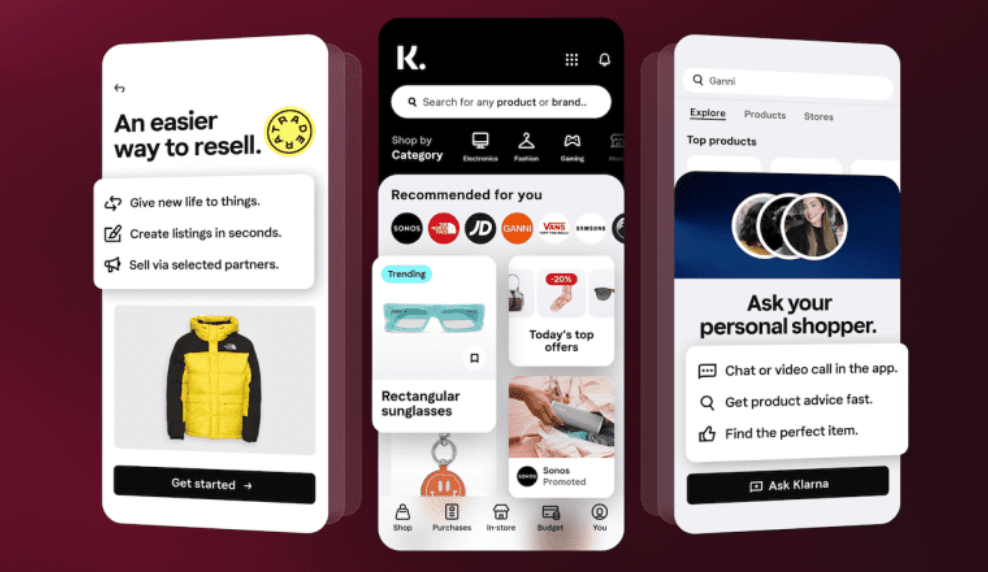

Buy Now, Pay Later company Klarna unveiled an AI-powered shopping feed this week, expanding its microcredit business into a full blown marketplace assisted by OpenAI’s GPT technology. Similar to ecommerce platform Shopify’s new Shop.app, Klarna hopes its new marketplace expands its customer appeal beyond those looking to finance small purchases for mostly clothes with a AI personal shopper.

Elon Visits Capitol Hill

American industrialists have always been reliant on the Federal government to support their ambition, and Elon Musk is no different. Much of the growth of Tesla can be attributed to Federal tax incentives for EVs, the vast majority of SpaceX revenue comes from government contracts, and even The Boring Company can’t operate without the explicit consent of elected officials.

Therefore it’s not unusual for Musk to visit the US Capitol, which he did this week to meet Senate Majority Leader Chuck Schumer (D-NY). What was unusual was the reported main topic of conversation: the threat of AI. We’ve reported previously on the Musk-funded EU lobbying group pushing for a pause on AI development and it would appear that Elon is now bringing that effort directly to the US government.

Senator Schumer stated, according to Reuters, that he was working on a “framework that outlines a new regulatory regime that would prevent potentially catastrophic damage to our country [from AI] while simultaneously making sure the US advances and leads in this transformative technology.”

Musk said that they also discussed Tesla’s solar panel factory in Buffalo and “the economy generally.” No word if they discussed Musk’s question to Senator Schumer last month about January 6 footage released by House Speaker Kevin McCarthy.

Sweetgreen’s Sweetpass Joins Growing List of Restaurant Subscriptions

Investors love recurring revenue and the restaurant industry has taken notice, integrating subscription discount plans into their digital payment systems. Here’s a rundown of some of the most significant products in this space, starting with the latest update from Sweetgreen.

- Sweetgreen Sweetpass gives $3 discounts for $10 per month

- PF Chang’s Platinum Plan offers free delivery and priority reservations

- Panera Extends Its $11/month unlimited drinks promotion year round

- Pret Offers Unlimited Coffee for $30 to $40 per month

Despite Offer To Unbundle Teams From Office, Microsoft Acquisition of Activision Blocked by UK

Antitrust scrutiny of Big Tech continues with support of American politicians from both parties as well as regulators in Europea. We’ve reported previously on the bruising Congressional inquiry into TikTok and the far reaching implications of the RESTRICT Act. This week Microsoft ceded some ground to regulators by offering to unbundle its chat and video meeting service Teams from its core Office product.

The move came amidst Microsoft’s beleaguered attempt to acquire video game maker Activision Blizzard. While no explicit quid pro quo is apparent, the timing of the offer while the $68 billion deal is pending seems like more than a coincidence. If the Teams concession was an olive branch to European regulators — responding to complaints from Salesforce’s Slack that the bundling of teams is anticompetitive – it didn't work, as UK regulators this week officially quashed the proposed takeover on anticompetitive grounds.

According to FT, the negotiation about unbundling Teams is ongoing and could change. If Microsoft backs away from this offer in the aftermath of the Activision deal’s collapse, the implications of the original offer would become even more obvious.